Current Cardholders

If you discover that your PSFCU Visa credit card is lost or stolen, you should contact us immediately at any of the numbers below:

Credit Card Customer Service (available 24/7)

(800)-449-7728– Domestic calls

(727)-299-2449– International calls (collect call accepted)

PSFCU Member Services Center (during PSFCU business hours; assistance in Polish)

(855) 773-2848 - Domestic calls

(973) 808-3244 - International calls

VISA (available 24/7)

(800) VISA-911 – Domestic calls

(410) 581-9994 – International calls

Set up Travel Notifications

Do you plan on traveling now or in the near future?

Let us know by setting up a Travel Notification (PSFCU Online Banking/Credit Cards) so we can provide better support and monitoring for your card while you travel.

Before you go, make sure that the contact information we have on file for you is current, including your

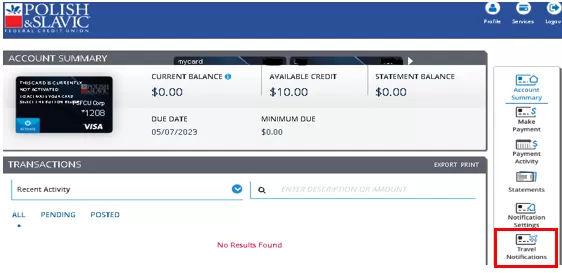

To set up travel notifications, log in to PSFCU Online Banking and select 'Credit Cards' from the menu. Once you are on the Account Summary page, select the card you want to create a Travel Notification and select ‘Travel Notifications’ in the navigation bar.

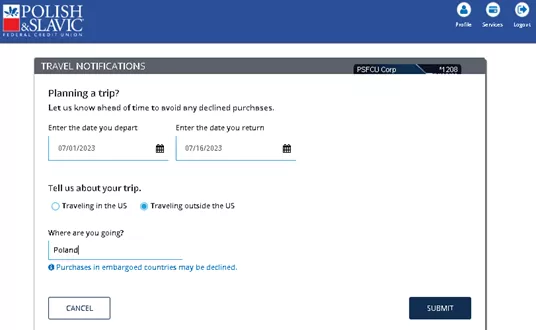

1. The Travel Notifications page appears.

- Select the dates from the calendar icon for your departure and return date.

- Indicate whether you are Traveling in the US or outside of the US.

- Input the name of the city, state, or country.

Use commas between destinations if you plan multiple stops.

3. Select the Submit button. The confirmation displays.

Traveling internationally? We encourage you to take a look at Visa International Travel Tips posted in our Educational Corner.

Enjoy your travels!

Set up Alert Notifications

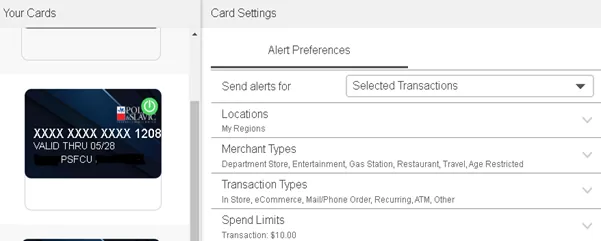

Through our Online Banking credit card access in DX Online, we provide our cardholders with a solution that allows them to manage various alerts over their credit card accounts.

An Alert is a notification a notification sent to the cardholder to let them know that a transaction occurred against their credit card based on their alert preferences.

For example: if a cardholder requested to be notified of a transaction greater than $100.00, each time there is an authorization for amount exceeding $100, the cardholder will receive an alert.

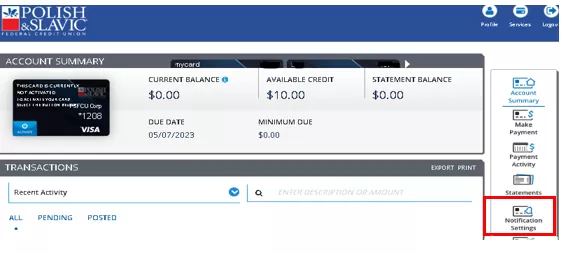

To set up alert notifications, log in to PSFCU Online Banking and select 'Credit Cards' from the menu. Once you are on the Account Summary page, select the card you want to create an Alerts Notification and select Notifications Settings in the navigation bar to begin alerts enrollment.

Alert Types

The Alerts app offers the following alerts:

- Locations

- Merchant Types

- Transaction Types

- Spend Limits

Locations

You can set location alerts to receive notification when their credit card is used outside of selected locations. There are two types of location alerts.

My Regions:

Sends an alert when a credit card transaction occurs at an instore merchant outside of the regions specified by the cardholder.

Example:

The cardholder selects New York and New Jersey as approved regions since they travel there frequently on business. A transaction takes place in Illinois.

Alert: The cardholder receives notification.

International:

Sends an alert when a credit card takes place at an instore merchant outside the cardholder’s country of residence.

Example:

The cardholder lives in the US but a transaction takes place in Poland.

Alert: The cardholder receives notification.

Merchant Types

You can set Merchant Type alerts to receive notification when their credit card is used at selected merchant types.

Available Merchant alerts.

Alert Type: Description

Department Store: Includes clothing, accessories, office supplies, electronics, etc.

Entertainment: Includes amusement parks, movie theaters, arcades, etc.

Gas Station: Includes fuel dispensers, warehouse club gas, etc.

Grocery: Includes supermarkets, bakeries, butchers, etc.

Household: Includes utilities, contracted services like electricians, plumbers and A/C repair, etc.

Personal Care: Includes drug stores, pharmacies, health professionals, etc.

Restaurant: Includes diners, fast-food, cafeterias, etc.

Travel: Includes airlines, car rental, hotels, etc.

Age Restricted: Includes liquor stores, smoke shops, casinos, adult stores, etc.

Other: Purchases at other merchants.

Transaction Types

You can set Transaction Type alerts to receive notification when their credit card is used for selected transaction types.

Available Transaction alerts.

Alert/Alert Type: Descript Description ion

In-Store: Includes department stores, pharmacies, other retail stores, etc.

eCommerce: Includes online bill payment, online shopping, etc.

Mail/Phone Order: Includes catalog shopping, travel agents payments, etc.

Auto Pay: Includes automated bill payment, monthly suspense payments, etc.

ATM: Includes bank ATMs, vendor ATMS, cash advance, etc.

Other: Includes other cases outside of standard types.

Spend Limits

You can set Spend Limit alerts to receive notification when a credit card transaction exceeds specified dollar limits.

Alert Type tr Type: Desc Description ion

Per Transaction: Set an amount to receive an alert when exceeds the set transaction limit.

Per Month: Set an amount to receive an alert when transactions for the month exceed a set limit.

Member Alerts are real-time SMS text notifications or emails alerting the cardholder of certain activities triggered by previously set up transaction alerts.

Digital Wallet Technology

Discover more ways to pay by adding your PSFCU credit card to your mobile device then shop in-store and online using Apple Pay®, Google Pay™ or Samsung Pay.

Check out Visa’s website for additional information on Mobile Payments:

Contactless Chip Technology

Simply tap to pay where you see the Contactless Symbol. You can make purchases quickly, easily, and securely at millions of locations.

Want to learn more about the contactless payments, and where and how you can tap to pay? Check out Visa’s website at USA.Visa.com | Contactless-payments

PSFCU Bill Pay

Setup one-time or recurring payments from your PSFCU Checking accounts, and your payment will be made automatically on the requested pay date.

PSFCU Mobile App

Make a payment by transferring money from your PSFCU account and have the funds instantly available for new purchases.

Log in to your Mobile App, go to Transfers, and select from which PSFCU account you are making the payment from, and then to which the credit card account.

PSFCU Online Banking

Setup one-time or recurring payments from your PSFCU or other accounts, and your payment will be made automatically on the requested pay date.

Log in to your account online, go to Credit Cards and click Make Payment. You will need the following information to schedule a payment for the first time:

- Payment Information: Financial Institution Routing Number, Account Number and Account Type (Savings or Checking)

- Valid Email address

Payments at a PSFCU Branch

Visit any of our branches to make a payment in person. Please click here for a complete list of PSFCU Branch locations.

Over the Phone (PSFCU Member Support Center)

Contact the PSFCU Member Services Center or Card Servicing Department during regular business hours at 1.855.PSFCU4U (1.855.773.2848). Payment requests over the phone are processed via Intell-A-Check service and there is a fee of $10.00 per card account*. When calling, please have the following information available:

- Your Credit Card number

- Your Payment Information: MICR number from a blank check issued by your financial institution containing a routing number, and financial institution name

Over the Phone (Directly through Credit Card Processor)

This service is available in English only.

Please note that the fee is associated with this service: $15 fee for Consumer Cards / $20 fee for Business Cards.

- Call 855.594.9460 (Visa Elite/Signature Credit Card)

- Call 855.594.9459 (All Other Credit Cards)

When calling, please have the following information available:

- Your Credit Card number

- Your Payment Information: MICR number from a blank check issued by your financial institution containing a routing number, and financial institution name

By Mail

When sending payment by mail, make sure to allow sufficient time for delivery.

Payment mailing address:

Polish & Slavic FCU

P.O. Box 37603

Philadelphia, PA 19101-0603

For your protection PSFCU Visa credit card is constantly monitored for fraudulent activity. Please be aware that in instances of “out-of-norm” transactions (i.e. travel, high risk purchase, etc.) your card may be blocked and/or our Fraud Detection Work Center will attempt to contact you immediately to verify the suspicious transactions on your credit card. As such, it is important that your telephone number on file with us remains current as this will be the contact number used by our Fraud Detection Work Center.

If you discover that your PSFCU Visa credit card is blocked you should contact us immediately to verify your recent activity by calling any of the numbers below:

Credit Card Customer Service (available 24/7)

(888) 918-7313 – Domestic calls

(727) 299-2449 - International calls

PSFCU Member Services Center (during PSFCU business hours; assistance in Polish)

(855) 773-2848 - Domestic calls

(973) 808-3244 - International calls

You can conveniently select your PIN by calling 1-888-886-0083.

Please note that if there is one or more user on the account, each cardholder will be required to call in separately to customize their own PIN, while validating from the Primary cardholder’s information.

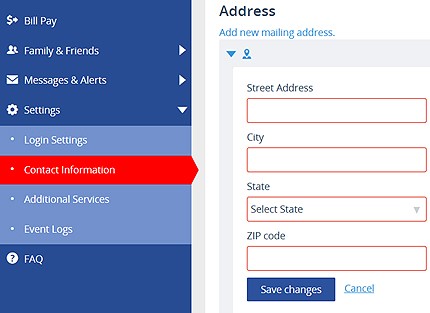

You can change your address online at any time by logging in to your account in Online Banking and selecting Contact Information located in the Settings menu option. If you require any assistance, please do not hesitate to contact us - click here for contact information.

Freeze and Unfreeze Your Card

If you believe that your card was temporarily misplaced, you can quickly and easily lock and unlock your credit card using any of the PSFCU digital channels, online and mobile, in-branch or over the phone.

To check all Visa promos and Perks got website https://usa.visa.com/en_us/visa-offers-and-perks/