About Our Credit Union

| Credit Union | Bank |

|---|---|

| Owned by its members | Owned by shareholders |

| Profits are returned to its members | Profits are returned to shareholders |

| Credit unions are subject to more restrictive regulations which prevent them from participating in riskier investments | Banks are subject to less restrictions on investment types |

| Credit unions are not subject to most taxes | Banks are subject to taxation |

| Credit unions are community oriented, that is why we speak Polish at P-SFUK! | Banks lack ties with communities they serve – they rarely speak Polish |

| Deposits are insured by NCUSIF up to $250,000 | Deposits are insured by FDIC up to $250,000 |

| Our Credit Union offers better dividend rates and lower fees | In general, banks charge higher fees |

| Our Credit Union fashions its products according to our members’ needs | Since banks cater to the general population, banks offer standard products |

Unlike large banks which charge increasingly high fees, our Credit Union offers not only products tailored to the specific needs of our members, but also offers more favorable dividend rates on deposits and lower fees for services. In addition, all of our Credit Union products and services are offered in two languages: English and Polish.

Our Credit Union’s checking account is offered free of charge. So is our Visa debit card. Meanwhile, banks are increasing their fees to recapture losses associated with the economic crisis, statutory reduction in interchange charges and low interest rates.

In the fall of 2011, Los Angeles shop owner, Kristen Christian, became annoyed by the high fees charged by the Bank of America and she decided not only to close her account and transfer to a credit union, but she also used Facebook to announce her decision to the whole world. In addition, she called on everyone to move their accounts from commercial banks to credit unions and small local banks by November 5th. In this way, she launched a powerful social movement and November 5th, 2011 became known as the Bank Transfer Day.

You may open an account at PSFCU electronically or by visiting one of our branches. Our existing members can use PSFCU-provided template forms to transfer their accounts at other institutions to PSFCU. The forms contain instructions for closing an account, as well as changing payment and direct deposit instructions. You must print, complete, and sign an appropriate form and deliver it to the applicable recipient.

For the past thirty years, it has been the mission of Polish and Slavic Federal Credit Union to provide to its members the best quality products and services, that are carefully tailored to their needs, and be a source of financial support to our ethnic group in the United States.

Polish & Slavic Federal Credit Union was established in 1976 by the founders of the Polish & Slavic Center led by Rev. Longin Tolczyk. The founders wanted to help immigrants who, upon arrival in New York City, wanted to buy houses in Greenpoint but were turned down by banks. Banks were unwilling to extend credit for purchases or renovations of real estate properties to people who did not yet have established credit history. Especially, since these properties were located in an area that was run-down at the time.

For the first two and a half years of its existence, our Credit Union operated under the name “Industrial and Commercial Federal Credit Union.” The first significant success of our Credit Union was marked by the purchase of a building on 140 Greenpoint Avenue in Brooklyn, which became its official headquarters.

See out Initial Charter and Amendments.

PSFCU services are available to members of our Sponsor Organizations.

Sponsor organizations are independent from PSFCU and have their own membership criteria. All of the organizations offer membership to persons who can document their polish or Slavic origin. Some organizations have additional requirements.

About Credit Union Structure

For the past thirty years, it has been the mission of Polish and Slavic Federal Credit Union to provide to its members the best quality products and services, that are carefully tailored to their needs, and be a source of financial support to our ethnic group in the United States.

Polish & Slavic Federal Credit Union was established in 1976 by the founders of the Polish & Slavic Center led by Rev. Longin Tolczyk. The founders wanted to help immigrants who, upon arrival in New York City, wanted to buy houses in Greenpoint but were turned down by banks. Banks were unwilling to extend credit for purchases or renovations of real estate properties to people who did not yet have established credit history. Especially, since these properties were located in an area that was run-down at the time.

For the first two and a half years of its existence, our Credit Union operated under the name “Industrial and Commercial Federal Credit Union.” The first significant success of our Credit Union was marked by the purchase of a building on 140 Greenpoint Avenue in Brooklyn, which became its official headquarters.

See our Initial Charter and Amendments.

PSFCU services are available to members of our Sponsor Organizations.

Sponsor organizations are independent from PSFCU and have their own membership criteria. All of the organizations offer membership to persons who can document their polish or Slavic origin. Some organizations have additional requirements.

Debit Card FAQs

Call the 24/7 hotline:

- Domestic calls: 1-800-472-3272

- International calls: 1-973-682-2652

Or contact PSFCU Member Services Center

- Domestic calls: 1.855.773.2848 (1.855.PSFCU.4U)

- International calls: 1-973-808-3244

Individual Debit Card (combined limit) - $9,000

- "ATM PIN” transactions (when used at an ATM) - $1,000

- "POS PIN” transactions (store purchases using PIN number) - $2,000

- "Signature / Non-PIN” transactions (electronic transactions using card holder’s signature) - $3,000 (including Cash Advance $1,000)

- Bill Payment transactions - $3,000

Business Debit Card (combined limit) - $20,000

- "ATM PIN” transactions (when used at an ATM) - $2,000

- "POS PIN” transactions (store purchases using PIN number) - $6,000

- "Signature / Non-PIN” transactions (electronic transactions using card holder’s signature) - $8,000 (including Cash Advance $2,000)

- Bill Payment transactions - $4,000

Number of transactions per day

- Visa Debit Card purchases - 40

- Cash withdrawals (ATM transactions) - 10

- When you open a checking account online or at a branch you will be given the option to receive a Debit Card. If you already have a checking account, you may order your card at any branch or by calling our Member Services Center at 1.855.PSFCU.4U (1.855.773.2848).

- Upon receipt of your PSFCU Debit Card by mail, please activate it, and at the same time you will be prompted to select your own PIN, by calling the telephone number 1-800-992-3808. If calling international, please call 001-844-373-1729. For cardholders with an existing PIN - you can also activate your card at any ATM or by performing a PIN transaction.

- You will need a PIN to make transactions at any ATM or Point-of-Sale terminal. You may change your PIN number by calling 800-992-38-08 for domestic calls and 001-884-373-1729 for international calls.

- Upon activation, sign the back of the card and you can start using it immediately.

- PSFCU account co-owners can also get an individual Debit Card. Both cards can be used to perform transactions on the same checking account.

What is a ‘compromised’ Debit Card?

A card is considered ‘compromised’ when it is at risk of being used in a fraudulent manner. This can happen as a result of the theft of data stored in a computer, unauthorized computer network access, or of any other suspicious event. Card information can also be stolen when shopping at a store or when data is sent electronically when making an online payment

What does PSFCU do to notify members that their card information has been obtained by unauthorized persons?

The Polish & Slavic Federal Credit Union (PSFCU) treats all such events with the utmost caution. So much so, that we require all compromised cards, regarded as high-risk, be canceled immediately. We replace them with a new card at no cost to the cardholder. As a rule, we attempt to contact the cardholders by phone, email, or by mail to inform them about the situation.

Does this mean that unauthorized transactions have been posted to my account?

The fact that a card is considered ‘compromised’ does not mean fraudulent activity is present. In fact, this happens very rarely and of all the compromised card numbers we receive, very few of those have unauthorized transactions posted.

How can I avoid such situations?

We advise you to monitor your monthly account statement closely and systematically. As an added advantage, our Internet Banking allows you a constant access to view your account transactions.

Do all financial institutions block compromised cards and issue new ones after being informed that card numbers have been disclosed to unauthorized persons?

No, there is no such requirement. Some institutions don’t even inform their clients that they have received such information. They pass all responsibility for discovering fraud onto their clients. Conversely, PSFCU wants to protect our members from unauthorized use of stolen card numbers. This protects them against thieves who could use these numbers in the future, even months or years later. To evade such situations, we void these cards and issue new ones as soon as we receive information that the card numbers have been compromised.

What should I do if I notice fraud on my Debit Card account?

If the card has not yet been blocked, immediately call PSFCU at 1-855.PSFCU.4U (1.855.773.2848). After business hours, please call 800-472-3272.

What happens when a unauthorized transaction on my account clears and a lack of funds prevents me from fulfilling my financial obligations?

In the majority of cases, PSFCU will issue a temporary credit to member account which can be used while the investigation is in progress. We emphasize, however, that any fraud has to be reported to the PSFCU as soon as possible.

How soon after my card is canceled will I receive a replacement?

In the majority of cases, cards are received within two weeks from the order date.

What should I do if I do not receive a replacement card in time?

Please contact us at 1-855.PSFCU.4U (1.855.773.2848). After checking the shipment status, we will be able to provide you with further assistance.

What should I do after I receive a new card?

Upon receipt of your new card we ask that you destroy your old one. You may then proceed to activate the new card by following the attached instructions.

Will my PIN number change when I receive a new card?

Yes, to obtain a new PIN number the cardholder needs to use these two phone numbers domestic 800-992-38-08 or 001-884-373-1729 for international calls. Also, the cardholder can choose the same PIN number for the new card.

Is there a fee for a replacement Debit Card?

No, PSFCU does not charge any fees for replacing a Debit Card.

Can I avoid canceling my card even though its number has been compromised?

Every report that indicates possible fraud constitutes a serious threat to the funds deposited into your account. If the old card is not canceled, your account will remain at risk of unauthorized activity which could take place a days, weeks, months or even years later. Moreover, recovering lost funds can be a long and arduous process. While the amount of cases with unauthorized use is low, a risk of such activity will remain present until the card is replaced. To limit any losses and inconveniences arising from potential fraud, PSFCU requires that all compromised cards be replaced immediately.

What should I do if I have existing authorized automatic payments scheduled with various merchants?

Notify the company collecting the automatic payments immediately after receipt of a replacement card. You will have to change the card number and its expiration date. In some cases, you will be able to change this information on the company’s website while other’s will require a written notification. Consequently, please check the requirements directly with the company collecting such payments.

Does theft of one Debit Card number put another card, tied to the same account, at risk?

It depends. The fact that each card has a unique number reduces the risk of unauthorized use if only one number has been stolen. As a result, PSFCU takes measures to prevent the unauthorized use of card information. As a result, if data on an additional card has been stolen as well, PSFCU will take the same steps for both cards on this account.

Is stealing card information the same as identity theft?

Information coded on the Debit Card relates solely to the card itself such as the number and the expiration date. Personal data, such as the cardholder’s Social Security number, driver’s license number, address, or date of birth are never recorded on the card.

Can I protect myself against Debit Card information theft in the future?

Unfortunately, at this time there is no method of completely shielding client’s from had information stolen from retail databases or payment clearing houses.

What steps can I undertake in the future to protect my card against potential fraud?

- Always remember where you store your card. If you ever lose it, contact PSFCU immediately. The card will be immediately canceled to prevent it from unauthorized use. (After business hours, please call 800- 472-3272)

- Under no circumstances should you write your PIN number on your card.

- Never carry a written PIN number with you.

- Check your monthly statements thoroughly and systematically, immediately after you receive them.

- We recommend using our Internet Banking, which allows you a round-the-clock access to your account. You can also check your transactions by phone by contacting our Call Center at 1-855.PSFCU.4U (1.855.773.2848).

- Should you notice any inconsistency, contact us immediately.

What should I do if I notice an unauthorized transaction that has been posted to my account?

In order to be eligible for a refund of your money, you need to take the following measures:

- Please contact the company which received payment from your account to inform them that the transaction was not authorized by you and constitutes fraud resulting from stolen information.

- Immediately report any unauthorized transaction to PSFCU by calling 24/7 Costumer Service at telephone number 1(800)- 472-3272 which is located on the back of the card or at 1-855.PSFCU.4U (1.855.773.2848) and you will be transferred to extension 7220 and instructed to choose option 2 “For Debit Cards information” and 2 “To dispute transaction on your Debit Card”. If the claim is in person, PSFCU employees provide assistance with telephonic notice or translation assistance if necessary.

Using Your PSFCU Visa Debit Card while traveling

Before your trip, take the following steps to make the most of your PSFCU Visa Debit Card while traveling:

- Remember to notify us where and when you’ll be traveling. This way we will be able to update our fraud detecting systems to allow access and prevent your Visa debit card purchases from being declined in the area where you are planning to travel.

- Your Visa Debit Card is automatically enrolled in Fraud Alerts. This way, you will be notified by the monitoring system about a detected suspicious transaction via your mobile phone and will be able to verify the transaction.

You may also

- Be sure you know your 4-digit PIN. Some merchants may require a four-digit numeric PIN when using a debit card.

- Check your card’s expiration date before your trip.

General Account Questions

PSFCU's ABA or Routing Transit Number is: 2260-8202-2. Since the routing number identifies the financial institution, and not the type of account, the same number is used for every account.

A routing transit number (RTN), routing number, Institution Transit Number, or ABA number is a nine digit bank code used in the United States. It appears on the bottom of negotiable instruments such as checks and it identifies the "financial institution" on which the instrument was drawn. It is also used by Federal Reserve Banks to process Fedwire funds transfers (wires) and by the Automated Clearing House (ACH) to process direct deposits and other automated transfers.

Deposits can be made electronically by Direct Deposit or automatic payroll deduction, at ATMs located inside PSFCU branches, by mail or in person at any of our branches. In addition, A2A service available from Online Banking allows electronic transfers between accounts at PSFCU and other institutions.

To direct your deposits electronically to the PSFCU you must provide the payer with the account number and PSFCU Routing number, as they appear on your check. If you do not have a checking account and would like to direct the Payer to electronically deposit funds to your savings account, provide the number used for making deposits alongside PSFCU routing number.

Checks or money orders may be sent by mail to any PSFCU branch. Please make sure to endorse the back of your check or money order in the area provided and write “For Deposit Only”. Underneath your signature, please include your account number and the two-digit code for the sub-account. If you have a deposit slip available complete it as you would at a branch.

There are several different ways to request a copy of a check written against your account. You may retrieve a copy of the item online, or request it: by mail, via fax, over the phone or in person. Copies of checks cleared within the last 3 months are available to you at NO additional cost through PSFCU Online Banking to e-statement subscribers. Requests made through any other channel or for items that have cleared more than 3 months ago, a fee of $ 5.00 per check will be assessed to your account. Check copies are only available for seven years from the date of clearing.

To get a copy of your check using online banking, log-in to your account and follow these steps:

1. Click on E-Statements under Account Info

2. On the “View Statement” tab, select “Monthly Statement” and from “Account Description” select “Share Draft,“ find check number in the transaction history and click on the icon to view the image of the check.

4.Click “Print.”

To request a copy of your check via fax, please fax your signed, written request to Document Control Department: (973) 808-3237

To request a copy of your check by mail, please mail your signed, written request to:

Polish & Slavic FCU

PO Box

Fairfield, NJ 07004

Attn: Document Control Department

For requests originating by mail or via fax, please be sure to include your name, daytime phone number, account number, check number, the date the check cleared your account and sign your request.

To request a copy of your check over the phone, please call our Call Center. 800-297-2181

And lastly, to get a copy of your check in person, please visit your nearest branch with proper identification (State or Government issued ID) and a Member Service Representative will be glad to assist you. Please note that the fee for the service will be deducted at the time of request.

There are several different ways to place a stop payment on a check written against your account. You may process this request online, by mail, over the phone or in person. The processing fee for a stop payment is $25.

To issue a stop payment using Online Banking, log-in to your account and follow these few steps:

- Click on Checks Option from the task pane located on the left.

- Click on “Stop Payment”

- Complete all applicable fields and hit Continue.

- Confirm the information entered, accept the $25 processing fee and hit Continue.

Once accepted your check has been stopped! Should you encounter any difficulty during this process, call our Call Center 855-773-2848.

As a second best option to place a stop payment, we recommend contact with our Member Service Center. Have the check information available when you speak to our Member Service Center Representative.

And lastly, to issue a Stop Payment in person, please visit your nearest branch with proper identification (State or Government issued ID) and a Member Service Representative will be glad to assist you.

Please note that a stop payment is in effect for six months from the date it is put in place, and may not be processed for any items which have already cleared an account.

PSFCU offers coin collection service at all branches. When you come in simply drop your change into the machine and let it count it. Some unrecognizable or damaged coins may be rejected. Once the coins are counted the machine will produce a receipt that must be presented to the teller. The transaction is subject to a 7% fee for PSFCU members and a 12% fee for non-members.

Log-in to your Online Banking and select E-statements. Follow prompts through the registration process. You may also contact our Call Center during PSFCU business hours by calling (800) 297-2181.

Online Banking has been secured to protect the privacy of your information. To get to the information, you must supply a user name and a password. When you first sign up for Online Banking you will get a temporary password. The first time you log on, you will be prompted to change the temporary password. Only you know the password you choose. In addition, you will be asked to select additional security questions based on the information only known to you. Those questions will be used to verify your identity when you try to access your account from another location. Employees do not have access to your password. Once you are in the system, any information transmitted over the Internet is encrypted to prevent exposure.

During business hours, contact our Call Center at (800) 297-2181 or stop by any PSFCU Branch and one of our Representatives will reset it for you.

If you activated automatic password reset in Online Banking, you may reset your password from the Log-on screen in Online Banking. Select Forgot Your Password? link and you will be prompted to enter your username and the email address on file. Your temporary password will be sent to your email . You may also request a password reset by calling our Call Center at (800) 297-2181.

Yes. Once you are logged into Online Banking, select "Update User Info" and go to “Change Your Password.” Follow the prompts to complete the password change.

PSFCU's FREE Online Banking allows you to access your accounts 24 hours/7days a week. You can get current balances on your savings and loan accounts, pay bills, view account history (deposits, withdrawals, transfers and cleared checks) and make fund transfers to other PSFCU members and between your accounts inside and outside of PSFCU.

PSFCU’s Bill Payment feature of Online Banking allows you to pay any bill, any time you like. You can pay either one time only payments or recurring payments from your computer, no matter where you are. Bills are paid either electronically or by check. You can also pay individuals, provided you know their address and telephone number.

To add a joint owner to your account, a new signature card is required with all joint owners’ signatures. To remove a joint owner, a removal card must be signed by the joint owner who appears before our Member Service Representative. In the event of a death, a death certificate must be presented and the name will be removed. Both of these types of transactions can be done at any of our branch offices.

You can order new checks via Online Banking by selecting “Checks” from the main menu and then “Re-order Checks”. The link will take you to Harland Clarke Holdings Corp. our check printing service provider. Follow prompts to enter your order. You may also request a re-order over the phone from our Call Center at (800) 297-2181 or by mailing in the check order request from the last book of checks in your box. The processing time is generally 10 -14 business days. It will be necessary to have your checkbook in front of you for the order to be placed, as well as your last check number.

You will receive a maturity notice approximately 30 days prior to the maturity date. You have until the maturity date to let us know your intentions, either in writing or over the phone. If we do not hear from you prior to the maturity date, your certificate will follow the default provision – it will either mature or renew for the same term at current dividend rate. You may redeem your certificate penalty-free within a 10 day grace period from renewal.

- If you have an iOS or Android smartphone, you may download an app from the online app store offered by the phone manufacturer, or scan the code provided above.

- Type in the username and password that you use for logging into your Online Banking.

- Now you may begin using your account.

The deposit procedure is very easy. After logging in to your Mobile Banking account, select the Mobile Deposit option, select the account to which you want to deposit your check from a pull-down list, enter the amount of deposit and take a photograph of the front and back side of your check. The deposit is completed after pressing the ‘Submit’ button and you will receive a confirmation e-mail to the address registered on your account. If you have any questions concerning this application, please do not hesitate to contact our Member Services Center at 1.855.PSFCU.4U.

PSFCU Mobile Banking app allows users to deposit checks at any time, from anyplace. Each day, you will be able to deposit checks up to a total amount of $20,000 and unlike numerous large banks offering a similar service, PSFCU has not set a low monthly deposit limit. In order to take advantage of this option, you need to download the newest version of the PSFCU Mobile Banking app and install it on your smartphone.

Mortgage Loans

This "traditional" and most popular type of mortgage maintains its original interest rate and monthly payment throughout the entire life of the loan. Fluctuations in market rates, over the term of your loan, won’t have any impact on the amount of interest you pay. This may be a good choice for Members who plan to stay in their home for an extended period of time.

We offer residential Fixed- Rate Mortgage loans in 10-, 15-, 20- and 30-year terms.

Interest rate and monthly payments change every 12 months during a 30-year term.

Because ARM's are subject to rate adjustments later on, the initial interest rate is set lower than standard fixed rates. This rate provides you with initial lower payments for increased purchasing power (you can qualify for a higher mortgage amount).

In addition to the standard ARM program that adjusts annually, our programs provide an initial fixed rate for 3, 5, 7 or 10 years before the rate can be adjusted annually. These options are best for those who want added payment stability and lower monthly expense.

An Adjustable Rate Mortgage may be a good choice if you:

- Want to keep your payments lower during the first few years of your loan.

- Plan to move into a different home within the next 3 to 10 years

- I In the coming years, you expect your income to increase significantly

- Property owner must be an individual not a business

- Property must be occupied by the owner

- Property can be a 1-4 family residence without any commercial space, condominium, secondary residence or cooperative apartment

Loans up to these limits are offered with the current interest rate:

(According to FNMA limits, as of 1/1/2019):

- for a 1-family house, up to $484,350

- for a 2-family house, up to $620,200

- for a 3-family house, up to $749,650

- for a 4-family house, up to $931,600

Loans for amounts higher that the FNMA limits are called “Jumbo” loans and may be offered with higher interest rates.

Down Payment Requirements Are:

- 3%–19.99%

- for a person with legal status in the United States, and

- with mandatory purchase of a Private Mortgage Insurance (PMI)

- – minimum 3% for 1 family homes (5% for Fixed Rate Mortgages) - PMI paid monthly or as single premium at closing

- – minimum 5% for condominiums and 15% for 2 family homes - PMI premium paid monthly, added to regular monthly mortgage payment.

- 20% and above

- without mandatory purchase of Private Mortgage Insurance (PMI)

Rate Lock -In option is available for fixed and adjustable rate residential mortgages. A one time, non-refundable fee is required for the rate-lock in the amount of .25% of mortgage amount (i.e. mortgage amount $100,000 - rate lock fee is $250.00). If this option is selected at application, members can lock the interest rate at any time until 5 days prior to closing.

Enrollment Requirements

- Every online banking user is required to have a unique e-mail address on file at PSFCU

- If you do not have an e-mail on file, please contact the PSFCU Member Service Center at 1.855.PSFCU.4U

- To enroll, you will be prompted to verify your identity, providing the following information; your PSFCU savings account number, e-mail, birth-date, and Social Security Number or Government Issued ID

Registration and Login

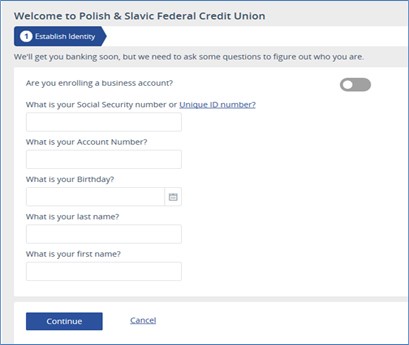

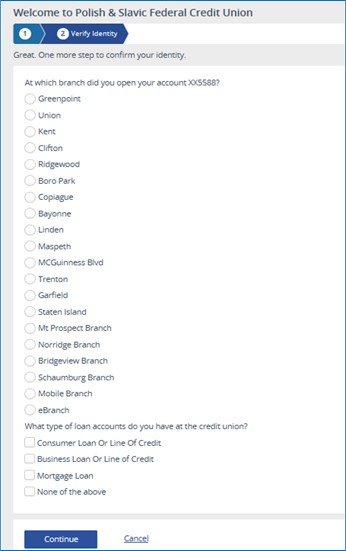

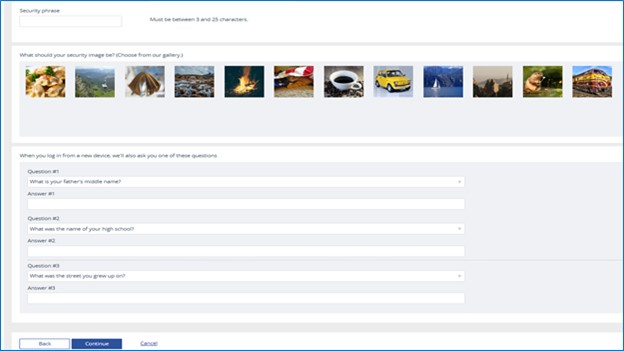

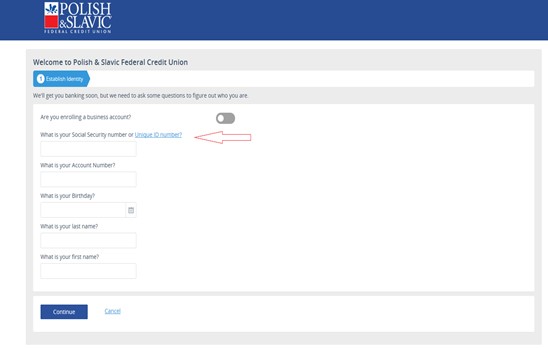

To enroll for Online Banking, you will need to complete a one-time registration process:

- Click on the orange Online Banking button on the left side of the PSFCU home page

- Select Register

- Select whether you are enrolling an Individual or Business account

- Accept the Disclosure

- You will be asked to verify your identity by providing the following information:

- PSFCU Savings Account Number

- Birth Date

- Social Security Number or Government Issued ID Number

- Select Continue

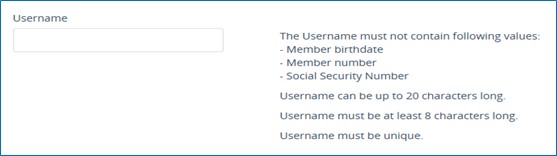

- Enter your desired new username. The system will verify whether this username is unique and available.

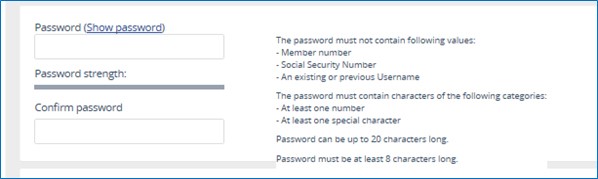

- Set up a new strong password

- You will be asked to provide the last 5 digits of the Government Issued ID that PSFCU has on file for you instead of a Social Security number

- You must have a unique email address on your account to successfully register for Online Banking. If you do not have an email address provided on your account, please contact PSFCU to update the personal information on your account.

To register your business account for PSFCU Online Banking, you need to complete a one-time registration process. You will need to provide the following information: PSFCU savings account number, email, and EIN.

- Select Forgot Username

- You will be asked to provide the following informaion: PSFCU savings account number, birth date, email, and SSN or Government Issued ID #.

- If the information in these fields accurately matches an existing Online Banking account, your username will be displayed to you.

- Select Forgot Password

- You will be asked to provide the following information: your usernmame, PSFCU savings account number, email, and SSN, EIN, or Government Issued ID #.

- If the information in these fields accurately matches an existing Online Banking account, you will be prompted to create a new strong password.

- You can change your Password anytime by logging into Online Banking and navigating to Tools -> Settings -> Security.

- You will be asked to provide your current password and your new strong password.

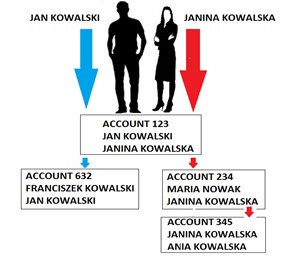

Accounts Linked by Social Security Number

- When you log into your Online Banking account, the accounts that you will see are all the ones on which your Social Security number has been provided as either the primary or joint owner. Please note that Power of Attorney individuals will also see any accounts on which their Social Security number has been provided.

- Accounts displayed to joint owners on the same account may differ significantly depending on their ownership rights in other accounts at the credit union

If you would like to delete your digital banking data at Polish & Slavic FCU, you may use the following options:

- Call us at 1.855.PSFCU.4U (1.855.773.2848);

- Send us a secure message through Online or Mobile Banking;

- Email contact@psfcu.net.

Security Center

Protect yourself from identity theft and learn what to do if your identity is stolen.

Identity theft occurs when someone uses your personal information without your knowledge to commit fraud or other crimes. In many cases, the victim is unaware of the activity until months after the incident. The effect of identity theft can be costly to you in terms of time and money.

Identity Theft can happen in various ways:

- After someone steals your wallet, purse or mail.

- By stealing personnel records from employers.

- By pretending to be financial institutions or businesses and sending spam email (called phishing) or pop-up messages in an attempt to get you to reveal your personal information.

- Identity thieves will also rummage through the trash at your home or workplace looking for bills or other documents with your personal information on it.

To protect your identity, you should:

- Review your credit reports. You can do this for free annually! Visit AnnualCreditReport.com or call 1-877-322-8228, which were established to handle consumer requests by the consumer reporting companies Equifax, Experian and TransUnion.

- Place a fraud alert on your credit bureau files if you feel information has been exposed.

- Adopt daily practices like shredding your personal & financial documents, staying aware of the latest scams, protecting your home computer with anti-spyware, virus detection software and firewalls. Keep these programs up to date.

- Secure your mail by utilizing a Postal Service Mail Box or by placing your outgoing mail into locked mailbox.

- Sign up for estatement services – not only does it protect your monthly statement, it also cuts down on paper and postage expense!

- Safeguard your Social Security Number – don’t leave your Social Security Card in your wallet and ask why when a person requests your SSN for business purposes.

- Don't leave a paper trail. Never leave ATM, credit card or gas station receipts behind.

- Know with whom you are speaking with before providing any confidential information. If you are not sure about the legitimacy of the caller, hang up and call back by utilizing a telephone number familiar to you.

- Never click on links sent to you by an unsolicited email.

- Be alert for warning signs of possible Identity Theft, such as:

- Regular bills that do not arrive as expected.

- Denials of credit for no apparent reason.

- Account Statements or credit cards in the mail that you were not expecting.

- Calls or letters concerning purchases you did not make.

If you think your identity has been compromised:

- If your bank accounts have been compromised, immediately notify those Financial Institution(s). Make a note for your file of what Institution was contacted, who you talked to and the date/time your call was made.

- Place a verbal password on your accounts to prevent thieves from calling in and finding out more about your financial transactions.

- Close or transfer those accounts that have been compromised or tampered with to a new account number.

- Request that any account that was fraudulently opened in your name be closed immediately.

- Place a Fraud Alert on your Credit Report. You can do this by contacting the Credit Bureaus:

- Experian: 1-888-397-3742

- Equifax: 1-800-685-1111

- TransUnion: 1-800-888-4213

- Request a copy of your Credit Reports and review them carefully. Question any unknown activity and report disputes in writing.

- File a police report and maintain a copy in your file for future reference.

- File a report with the Federal Trade Commission. You can do this online via ftc.gov

Keep an eye out for future attempts. Identity Thieves often will lay low for months and then strike again, hoping to catch you off guard.

Learn how to defend against internet fraud, fraudulent e-mails, viruses and spyware.

Online scams and viruses are constantly evolving and they threaten the security of computers worldwide. As criminals evolve their tactics, you need to keep your PC's security software (virus detection, security patches, etc.) up-to-date. The more you know about how to protect your computer and yourself, the less likely you are to be negatively impacted.

- Be suspicious of any email with urgent requests for personal financial information.

- If you don’t know the sender, do not use the links in the email.

- Avoid completing forms in email messages that ask for personal financial information.

- Be sure to use a secure web site when submitting credit card or other sensitive information via the web browser.

- If you are not sure of the website's legitimacy, or if the offer sounds too good to be true, don't provide your personal or financial information. Verify the website by checking with a consumer information site such as the Better Business Bureau or Ripoff Report.

- Regularly check bank, credit and debit card statements to ensure all transactions are legitimate.

- Use security software (virus detection, firewalls, etc.) that update automatically.

- Keep your passwords for online activity in a secure place; do not leave them in plain sight or share them.

- Make sure your browser is up-to-date and security patches have been installed.

- If your home PC is utilized by multiple family members, consider purchasing a second PC or a laptop that will only be utilized for your online banking and storing of your financial information (ex: Quicken or TurboTax). A PC or a laptop utilized by multiple users presents the opportunity for malware being unknowingly downloaded on to it.

- If you think that your PC has been compromised, stop using it immediately, disconnect the internet access and have it checked for malware. If you believe that your online banking has been compromised due to malware, notify your financial institutions immediately.

Email Phishing

Phishing (pronounced "fishing") is a scam to steal valuable information such as credit card and Social Security numbers, user IDs, and passwords. In phishing, also known as "brand spoofing," an official-looking email is sent to potential victims pretending to be from their ISP, credit union, bank, or retail establishment. Emails can be sent to people on selected lists or on any list, and the scammers expect some percentage of recipients will actually have an account with the real organization.

Protect Yourself

Polish & Slavic Federal Credit Union will never send an email to verify your account information. If you receive an email claiming to be from the Credit Union that requests that you provide personal information in an unsecure email or via a link to a website, please contact the Credit Union immediately.

The Better Business Bureau and Ripoff Report are not affiliated with the PSFCU.

Guidelines to avoid check scams and how to protect your accounts.

Don’t get scammed out of your hard earned money! There are many variations of the counterfeit check scam. Modern computer technology allows crooks to easily create realistic looking personal checks, business checks, Cashier's Checks or Money Orders. It could start with someone giving you an “advance” on a sweepstakes you’ve supposedly won, a great work from home offer or asking you to help a family in a foreign country by transferring funds to your account for safekeeping. Whatever the pitch, don’t get caught with your guard down.

Here are some tips that will help you avoid becoming the victim of a counterfeit check scam:

- Shred any offer that asks you to pay for a prize or a gift. Legitimate sweepstakes offer consumers a chance to win a prize or money with no purchase or entry fee required.

- Know who you’re dealing with, and never wire money or send a check to strangers. If you must send a check, consider utilizing a Cashier's Check or Money Order instead of your own personal check to keep your personal information safe.

- Watch out for any lottery, secret shopper or business offer that involves you receiving a check and requires you to forward money by MoneyGram or Western Union.

- If you’re selling something, don’t accept a check for more than the selling price, no matter how tempting the offer or how convincing the story. Ask the buyer to write the check for the exact amount. If the buyer refuses to send the exact amount, don’t send the merchandise or a refund.

- Resist pressure to act immediately. Any legitimate offer should still be good after the check clears.

- If you're concerned about the validity of a check, either contact the Financial Institution by telephone (via the number you looked up) or take the check to the local branch office of that Institution.

- Watch out for any job opportunity that asks you to be a money transfer agent. Legitimate businesses should not ask you to deposit their checks into your personal account, then instruct you to forward the funds by wire or send by MoneyGram/Western Union to other individuals or to accounts in other countries.

- It’s best not to rely on money from any type of check unless you know and trust the person you’re dealing with or, better yet until your financial institution confirms that the check has cleared. Forgeries can take weeks to be returned through the banking system, and until you have confirmation that the funds from a check have cleared your account, you are responsible for any funds you withdraw against that check, whether or not the financial institution places a hold on them.

- Resist the urge to enter foreign lotteries. It is illegal to play foreign lotteries in the United States. If you are notified that you are a winner of a lottery that you didn’t enter, chances are you’re being scammed.

- Monitor your checking account activity carefully. A counterfeiter only needs to obtain the MICR line (those funny looking numbers on the bottom of your check) to create fake checks that are presented against your account.

Immediately report if you think you’re a victim of a check fraud scheme or if you notice something suspicious. Contact your Financial Institution as well as the local police department, or your local FBI Field Office.

Tips to recognize a phone scam.

Many people trust phone calls, especially if the person on the other side of the line knows even a small piece of information. Like email, phishing attempts can yield surprising results. Other fraud takes the form of involuntary commitment and contract approval.

Here are a few tips to recognize a phone scam:

- Never give out your credit card number on the phone unless you initiated the call to a reliable company that you know.

- Always ask for written information before you agree to anything.

- If you suspect that “something’s not right”, get off the phone right away.

- Don’t provide information that the company calling should already know.

- Avoid high-pressure sells.

Land Line Telephone Vishing, Mobile Phone Vishing & VoIP (Internet Phones) Vishing

Vishing, (Voice Phishing) also called "VoIP phishing for Internet phones," is the voice counterpart to phishing. Instead of being directed by e-mail to a Web site, an e-mail message asks the user to make a telephone call. The call triggers a voice response system that asks for the user's card number or other personal or financial information. The initial bait can also be a telephone call with a recording that instructs the user to phone an 800 number or another area code within or outside of the United States.

In either case, because people are used to entering card numbers over the phone, this technique can be effective. Voice over IP (VoIP) is used for vishing because caller IDs can be spoofed and the entire operation can be brought up and taken down in a short time, compared to a land line telephone.

Text Message Smishing

Smishing (SMS Phishing) is the mobile phone counterpart to phishing. Instead of being directed by e-mail to a Web site, a text message is sent to the user's cell phone or other mobile device with some ploy to click on a link. The link causes a Trojan to be installed in the cell phone or other mobile device.

Protect Yourself

Polish & Slavic Federal Credit Union will never call you to verify your account information. Be sure to use only the phone numbers that you know to be true for the Credit Union when responding to phone messages. If you have responded to a phone scam and provided any confidential account information, please notify Polish & Slavic Federal Credit Union via Contact Us link immediately.

Steps to protect yourself from loan fraud scams and predatory lending practices.

Loan fraud comes in various disguises - advance fee loans, easy debt elimination scams, instant credit repair schemes and mortgage refinance fraud - to name a few. In most cases, the person only wants to steal your money - which will cause you further financial stress. Sometimes, the scammer will use the personal and financial information that you freely provided to them to commit Identity Theft by applying for loans in your name.

Following these guidelines will help you stay out of the hands of loan scams:

- Never provide your personal or financial information for any loan application unless you know that the company is legitimate. Check the company's reputation first with consumer sites, the state licensing and regulatory agency that the business is based in and/or with the Better Business Bureau.

- Be wary of unsolicited calls, emails or letters offering you a loan. If the credit offer sounds too good to be true, it's probably a scam.

- Never provide an advance payment to obtain a loan. Legitimate companies never require any upfront payments for processing loans. Often, the scammer will take off with your money and your loan never materializes.

- Be wary of debt elimination scams. These scams often involve too good to be true claims of fixing any credit problem, erasing bankruptcy filings or raising your credit score overnight. Often these tactics are not legal and are practiced by entities that are not a legitimate, registered business. Watch out for any forms that you are required to sign that grant a special power of attorney that authorizes the person to engage in transactions regarding the title of your home on your behalf. In addition, the potential risk of you becoming an Identity Theft victim is high because you may have provided all of your personal information to a fake business.

- Be careful when asked to send money through a payment processor or asked to send money in the name of an individual (instead of the business).

- Be careful when dealing with a third party loan broker. These entities offer to do all of the loan application work for you based on a commission. Make sure that you know that the information about you being supplied to prospective creditors is honest and accurate, and that you are made fully aware of the terms and conditions of the loan being offered before you sign.

- Do not take a loan from a company that provides a guarantee that an application will be approved. Real companies will never guarantee the success of an application before they have performed a credit check.

- Never be pressured to wire funds. You can easily wire the funds once you have verified the company.

If you have been victimized by a loan scam, it is essential that you report it. If you decline to report the fraud due to embarrassment, you only leave the door open for the fraudsters to strike another victim. File a complaint with your local FBI Field Office and/or the Federal Trade Commission.

Information on how to prevent your card from being compromised.

Credit and debit card fraud costs cardholders and issuers millions of dollars each year. While theft is the most obvious form of fraud, it can occur in other ways. For example, someone may use your card number without your knowledge.

Here are some tips to help protect yourself from credit and debit card fraud:

Do:

- Sign your cards as soon as they arrive.

- Keep a record of your account numbers, their expiration dates, and the phone number and address of each company in a secure place.

- Keep an eye on your card during the transaction, and get it back as quickly as possible.

- Void incorrect receipts.

- Save receipts to compare with billing statements.

- Open bills promptly and reconcile accounts monthly, just as you would your checking account.

- Report any questionable charges promptly and in writing.

- Notify card companies in advance of a change in address.

Don't:

- Lend your card(s) to anyone.

- Leave cards or receipts lying around.

- Sign a blank receipt. When you sign a receipt, draw a line through any blank spaces above the total.

- Write your account number on a postcard or the outside of an envelope.

Give out your account number over the phone unless you're making the call to a company you know is reputable. If you have questions about a company, check it out with your local consumer protection office or the Better Business Bureau.

Examples of financial exploitation and how to avoid becoming a victim.

Financial Exploitation is any action which involves the misuse of an individual’s funds or property. Many people fall victim to financial exploitation by people that they know – paid caregivers, neighbors and even relatives. Sadly, the majority of victims are exploited by people they know than by con artists who are strangers. The results can be emotionally and financially devastating. Victims are usually older adults and are often too ashamed or embarrassed to report what was happened to them. The signs of Financial Exploitation may be subtle or blatantly obvious.

Examples of Financial Exploitation include:

- Coercing or threatening someone into giving away money.

- Charging excessive fees for caregiver services or rent.

- Forging signatures on checks, withdrawals slips or other financial documents.

- Tricking someone with a memory impairment, such as Alzheimer’s disease, into giving away money.

- The addition of a new joint owner to a well-established account, followed by frequent cash withdrawals.

- Credit Card and/or bank statements being sent to someone other the older adult who is the actual account holder.

- The committing of person to person, mail, or telephone fraud scams.

- An older adult fails to understand, or reasonable explain, recently completed financial transactions

Ways you can avoid problems:

- Utilize direct deposit for your checks.

- Review your financial statements carefully and promptly. Look for unauthorized withdrawals.

- Document financial arrangements – put all financial matters in writing and be specific. This protects you and reduces the chances of future misunderstandings. Keep complete records of your financial transactions.

- Don’t leave money, valuables, checkbooks or Debit/Credit Cards in plain view of others.

- Have an attorney, financial consultant or employee of a Financial Institution review account activity to detect changes in financial activity that may signal a problem.

- Don’t sign anything that you do not understand.

- Be cautious of opening joint accounts – understand that both parties are equal owners of the account and both will have equal access to the money on deposit.

- Don’t provide account information to strangers.

- Understand any Power of Attorney agreement before signing. Make sure that you know the person to whom you are giving this authority.

- Don’t allow others to use your ATM Card, Debit/ Credit Card. If you don’t use it, have the card canceled.

- Ask for help when you are unsure. Some financial matters can be confusing to you. Ask for help from a Financial Institution representative, a trusted family member, social worker or other professional.

What to do if you think someone is being financially exploited:

- Notify your Financial Institution. Speak to a representative privately (i.e. not in the presence of the person that you suspect is exploiting someone) about the problem.

Contact Your State’s Adult Protective Services or Department of Human Resources and file a complaint about the suspected activity.

Tips for protecting your financial data when using online banking.

Online banking is a convenient way to access or transact against your account. It is your responsibility to take the appropriate precautions to protect your own data, including information that can be used to access or transact against your account. We’ve listed some tips below:

Note: If you have enrolled in Polish & Slavic Federal Credit Union Online Banking, please also refer to the Polish & Slavic Federal Credit Union Online Banking Agreement for more specific information about your responsibilities for using the service and the protections provided under Regulation E.

Computer Security

- For any computer you use for online banking, shopping or similar activities:

- Maintain active, up-to-date antivirus, anti-spyware and firewall protection.

- Install operating system and software updates (i.e. “patches”, “service packs”) as soon as possible.

- Avoid these types of transactions at wireless hotspots or internet cafés.

- Use strong passwords that contain:

- alpha/number characters and symbols

- upper and lower case characters

- minimum of 8 characters but longer is recommended

- no real words, names or telephone numbers

- Change your passwords regularly.

- Never share your password or login information with anyone.

- Never bank or shop online using computers at kiosks, cafes, unsecured computers or unsecured wireless networks.

- When exiting an online banking session, always use the Log Out function and close the browser window.

Avoiding Phishing, Spyware, Malware

- Never open email from unknown sources.

- Never respond to a suspicious email or click on any attachments or hyperlinks.

- Be cautious of emails from financial institutions asking for personal or account information. Polish & Slavic Federal Credit Union does not send emails asking for personal or account information.

- Install a firewall, especially if you have a broadband Internet connection such as DSL or cable modem.

- For business members using online banking services – make sure the computers your employees use for work have the most up-to-date anti-virus/anti-spyware protection.

- For business members using online banking services – it is recommended you educate employees about current scams and loss-prevention steps, and perform a periodic evaluation of computer usage and controls.

For more information about Online Banking Security, refer to the Federal Trade Commission (FTC) website:

- Computers & the Internet: https://www.consumer.ftc.gov/topics/online-security

OnGuard Online (Provides practical tips from the federal government and the technology industry to help you be on guard against Internet fraud, secure your computer, and protect your personal information): http://onguardonline.gov/

Online wire transfers are an easy and secure way to transfer funds without leaving your home.

How to make a wire transfer in a few steps:

- Sign in to your Online Banking,

- Tap Transfers & Payments tab in PSFCU Online Banking.

- Create a list of Wire Payees.

- Add New Wire Recipient and enter the necessary personal and financial institution data.

- Go to the Make a Transfer tab,

- Select the account from which the funds will be sent

- Select the Wire Transfer option

- Choose the correct recipient

- Enter the transfer amount and add a comment

- A pop-up window will appear with the Confirm Your Transfer button

- After you click it, you will receive information confirming your request to transfer funds.

- You will also receive an email from PSFCU confirming the transfer.

If you request a wire transfer by error or make a mistake while making it, you can cancel the order. From the moment the confirmation is sent, you will still have 30 minutes to cancel your request.

- PSFCU offers a very convenient wire transfer service both internationally and domestically.

- In order to send a wire transfer, a member must have the following information

- Name and Address of the beneficiary’s financial institution

- SWIFT code or ABA number for the beneficiary’s financial institution (Please note that for all wires going to the European Union/European Economic Area, the account number must be in an IBAN format and a BIC/SWIFT Code must be provided)

- Name and address of the beneficiary

- Beneficiary’s account number

- Please refer to our Fee Schedule for a listing of current fees that may be assessed

- An international wire transfer typically takes three to five business days to reach its destination (depending in great measure on the beneficiary’s financial institution)

- Written wire transfer request may be subject to verification process.

- A domestic wire transfer is typically credited to the beneficiary’s bank account within 24 hours of processing by our wire department

To receive a wire transfer to an account at the PSFCU provide the sender with the following information:

Receiving Financial Institution Information:

Polish & Slavic FCU

100 McGuinness Boulevard

Brooklyn, NY 11222

ABA # 226082022

SWIFT/BIC: PSFCUS33

Your account Information:

Account number at the PSFCU

Name on the account

Address

For incoming wire transfers you can use this form click here (fillable version)

The PSFCU does not charge any fees for incoming wire transfer and is not responsible for any fees collected by correspondents of Foreign Banks for international outgoing wires.

International account numbers are usually longer. In the Polish banking sector, a bank account number in IBAN format consists of the 2-letter country code for Poland: PL, followed by 26 characters of the bank account numbers, as a result of which the following format is generated:

PL 00 1111 1111 2222 2222 2222 2222

- PL- country code for the country in which the account is serviced

- 00 - control digits

- 1111 1111 - 8-digit bank branch number)

- 2222 2222 2222 2222 - 16-digit account number

An example of BIC code for the National Bank of Poland is: NBPLPLPW.

Go to main navigation